Donate Through Pikes Peak

Enterprise Zone

You can receive a 25% tax credit by donating to SRC through the Pikes Peak Enterprise Zone Workforce Program for any donation of $250 or more.

About the program

The primary goal of the Enterprise Zone (EZ) Contribution Project Program is to create or preserve an environment that will help attract, expand, and retain employers in the EZ. State income tax credits equal to 25% of monetary contributions and 12.5% of in-kind contributions are available to Colorado taxpayers who make charitable contributions to approved non-profits that improve the economic conditions of the EZ.

How It Works

For the Pikes Peak Enterprise Zone Tax Credit, you must provide either a tax ID or the last four digits of your social security number.

If you are donating to SRC through our online donation page, please leave a note with your tax ID, the last four digits of your social security number, or a telephone number where an SRC staff member may reach you to acquire that information.

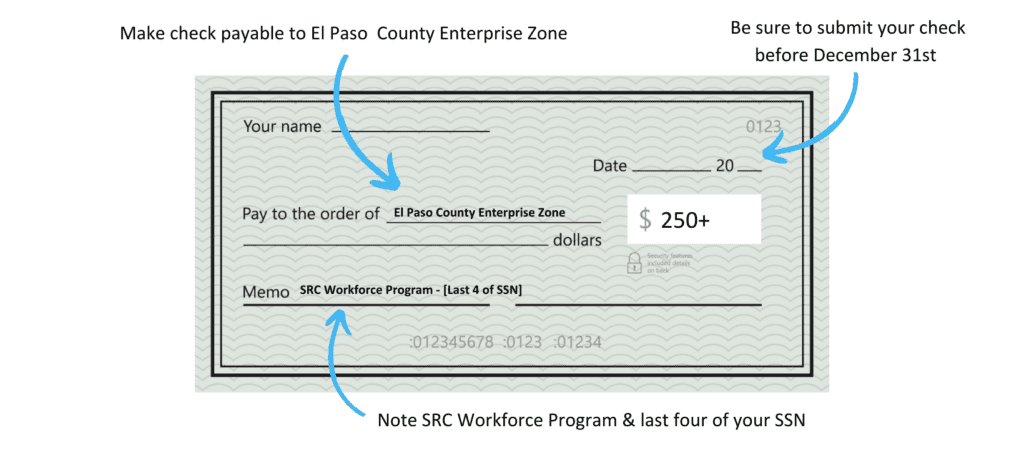

If you are donating to SRC by check, please follow the instructions below.